There is no Extended Morning Session and Afternoon Session on Christmas Eves, New Year and Lunar New Year. There will be no Extended Morning Session if there is no Morning Session. The Hong Kong stock market closes on public holidays.

Our mobile trading platform enables our clients to trade all stocks listed on the Hong Kong Stock Exchange, including Warrants, CBBCs, Exchange Listed Funds (ETF) and well as China Stock Connect (Shanghai Connect & Shenzhen Connect), along with U.S. securities.

Full Day Trading

Half Day Trading

Pre-opening Session

9:00 a.m. - 9:30 a.m.

9:00 a.m. - 9:30 a.m.

Morning Session

9:30 a.m. - 12:00 noon

9:30 a.m. - 12:00 noon

Extended Morning Session

12:00 noon - 1:00 p.m.

Not applicable

Afternoon Session

1:00 p.m. - 4:00 p.m.

Not applicable

Closing Auction Session

4:00 p.m. to a random

closing between 4:08

p.m. and 4:10 p.m.

12:00 noon to a random

closing between 12:08

p.m. and 12:10 p.m.

Full Day Trading

Half Day Trading

US (EST)

9:30 a.m. - 4:00 p.m.

1:00 p.m. - 5:00 p.m.

HK Time (DST)

9:30 p.m. - 4:00 a.m.

1:00 a.m. – 5:00 a.m.

HK Time (WT)

10:30 p.m. - 5:00 a.m.

2:00 a.m. – 6:00 a.m.

SSE/SZSE Trading Hours

Time for EP to input Northbound orders

Opening Call Auction

9:15 a.m. - 9:25 a.m.

9:10 a.m.-11:30 a.m.

Continuous Auction (Morning)

9:30 a.m. - 11:30 a.m.

9:10 a.m.-11:30 a.m.

Continuous Auction (Afternoon)

1:00 p.m. - 2:57 p.m.

12:55 p.m.-3:00 p.m.

Closing Call Auction

2:57 p.m.-3:00 p.m.

12:55 p.m.-3:00 p.m.

Thru a dedicated gateway to the Hong Kong Exchange, our client can access to the Northbound Trading of any eligible A-Shares under the China Stock Connect (Shanghai Connect “SSE” and Shenzhen Connect “SZSE”).

Note:

Amongst the various stocks listed in the Shanghai Stock Exchange (“SSE”) /Shenzhen Stock Exchange (“SZSE”), only A-Shares and ETF are included under the CHINA STOCK CONNECT. Other product categories such as B-Shares, Exchange Traded Funds (“ETF”), Bond and other securities are not included.

The Shenzhen Stock Exchange does not accept cancellation orders from 09:20 to 09:25 and from 14:57 to 15:00 (A-Shares and ETF), whereas the Shanghai Stock Exchange does not accept cancellation orders between 09:20 to 09:25 (A-Shares and ETF). Orders that are not matched during the Opening Call Auction period will automatically enter into the Continuous Auction period (Morning), orders that are not matched during the Continuous Auction period (Afternoon) will automatically enter into the Closing Call Auction period. For China Stock Connect (Shanghai & Shenzhen) trading hours, click this link to HKEX page .

The daily limit for transaction turnover of CHINA STOCK CONNECT is restricted by a daily aggregate quota, which is monitored by the Hong Kong Stock Exchange, Shanghai Stock Exchange and Shenzhen Stock Exchange respectively.

Trade order price limit is generally subjected to a ±10% restriction, in reference to the closing price of the previous day (5% for ST or *ST shares which are listed on the Risk Alert Board of the SSE).

Apart from the above-mentioned price limit, a buy order must be within a predetermined lower price limit, refer to link toHKEX page . If there is no current bid price, the latest executed price applies; Or if there is no current bid price and latest executed price, the closing price of the previous day will apply.

The order price of all CHINA STOCK CONNECT A-Shares must be within the pre-determined price limit, otherwise the order will be rejected by the SSE / SZSE. The upper and lower price limit of the trade order does not alter on the same day.

Transaction funds are settled by T+1 day, while stocks are settled on T day.

No reversal transactions (Day Trading). Shares of a particular stock bought on the day is not allowed to be sold the same day, it can only be sold on or after T+1 day;

Each Lot size is 100 shares and buy order must be by the lot size, unless if it is a sell order where odd lots can be sold. However, the odd lot of any particular shares must all be sold, along with the other complete unit(s) of shares lot together as one sell order where they will be matched with the same bid price at the same trading platform. Therefore, client’s buy order instruction may result in odd lot shares once eventually executed.

Only Limit Order is accepted under China Stock Connect. Trade order amendment is conducted by cancelling the original trade order following the placing of a new trade order.

Trade transactions of China Stock Connect is settled by RMB.

Only Institutional Professional Investors (“ISI”) is eligible for the trading of ChiNext Stock and STAR stock (Sci-Tech innovAtion board).

Northbound trading will only be open when both the HK and Mainland stock markets are Trade Day and when fund settlement services are available on both market on trade Settlement Day (that is T+1).

The Upper Limit for each trade order size is 1 million shares and the tick size is RMB0.01.

Foreign investors must comply with the 10% individual shareholding limit and the 30% aggregate shareholding limit and its associated force-sell requirement, as well as the 5% shareholding disclosure obligation applicable to China Connect A-Shares.

For more information about China Connect A-Shares, refer to:

IPO new shares subscription through our nominee is available for our clients to apply via our mobile trading APP or by contacting our Customer Service Team. Allotted shares are deposited into the client’s individual securities trading account with us on the allotment day, available for client’s disposal on the new stock’s first trading day. Alternatively, clients can also sell their allotted new shares via the IPO Pre-market (“Grey Market”) by calling our Customer Service Hotline during the IPO Pre-market trading hours.

Further, clients also have the option for Margin IPO Subscription to maximize individual capability which may enhance their chance of allotment.

This FAQ provides general information about trading US stock options. The information is for clients who engage in long US stock options strategies only.

Terms of service and Disclaimer for US Stock Options Trading

Well Link Securities Limited (the "Company," "we," or "us") provides a US Stock Options Trading Service (the "Service") to clients (the "Client," "you," or "your"). By using the US Stock Options Trading Service, you confirm that you have read, understood, and agreed to be bound by these Terms and Conditions, our《Securities Account Agreement》including its General Terms and Conditions and all relevant Schedule(s), and all other applicable laws, rules, and regulations.

1. Service Description

1.1. Platform: The Service is facilitated through the mobile trading application of Well Link Securities, which provides access to the US Stock Options market via our designated partner broker.

1.2. Eligible Securities: The Service allows you to trade a range of US Stock Options listed on major US Exchanges. You acknowledge and agree that the Company only permits the execution of Long Options Strategies, meaning you may only buy call or put options, but selling or "shorting" of options is prohibited.

1.3. Excluded Securities: The Company reserves the right, at its sole discretion, to exclude any options from the Service, including those with certain strike prices, expiration dates, or underlying assets.

2. Client Obligations and Responsibilities

2.1. Investment Decisions: You acknowledge that this is an execution-only service. You are solely responsible for all investment decisions, including the suitability of any particular transaction, option contract, or investment strategy. The Company, its employees, and its partners do not provide any investment advice or recommendations.

2.2. Risk Acknowledgement: You confirm that you have read and understood the risks associated with options trading, including but not limited to the potential for a total loss of the premium paid for the options contract.

2.3. Self-Directed Account: Your trading account is self-directed. You are responsible for monitoring your account, positions, and any corporate actions that may affect the options you hold.

2.4. Funding: You must maintain a sufficient balance in your designated USD trading account to cover all options purchase premiums and associated fees. The Company may, at its discretion, reject or cancel any order if there are insufficient funds.

3. Trading and Order Execution

3.1. Trading Hours: Orders may be placed during US market hours, from 9:30 AM to 4:00 PM Eastern Time (ET) (Note that some ETF options trade until 4:15 PM). The Company is not responsible for any issues or delays in order processing that occur outside of these hours.

3.2. Order Types: The Service supports various order types as available on the mobile trading application.

3.3. Order Execution: The Company and its partners will use commercially reasonable efforts to execute your orders promptly. However, we do not guarantee the execution of any order, and we are not liable for any losses resulting from delays, non-execution, or execution at a price different from your expected price.If you are unable to place an order, Because the market maker has not provided a quote for the options contract, please call customer service for inquiries.

3.4. Cancellation and Amendments: You may amend or cancel orders before execution. We do not guarantee that any cancellation or amendment request will be processed before the order is executed.

4. Fees and Charges

4.1. Trading Fees: You agree to pay all commissions, platform fees, and other charges related to your transactions as outlined in our official fee schedule available on our Company’s website www.wlsec.com. This includes fees passed on by third parties, such as regulatory fees, exchange fees, and clearing fees.

4.2. Other Charges: The Company may, at its discretion, charge for other services, including but not limited to corporate action processing and data feeds. All fees are subject to change without prior notice.

5. Settlement, Exercise, and Expiration

5.1. Settlement Cycle: All trades of US Stock Options will settle on a T+1 cycle (one business day after the trade date). The settlement of the underlying stocks resulting from options being exercised will also be completed on the next business day (T+1) following the relevant notice to exercise.

5.2. Exercising an Option at Maturity: Options that are in-the-money (ITM) at maturity are typically subject to automatic exercise, which usually occurs after the market closes on the expiration date. If the expiration date falls on a holiday, the timing may vary and the options will be exercised the actual execution time.

Exercising In-the-Money Long Call Options: If your long call option is in-the-money at maturity ([NOTE] it will be automatically exercised if the price is $0.01 or above. If it's below $0.01 and you do not exercise or close the position, it will lapse by default and become worthless), the system will check if you have sufficient cash to purchase 100 shares of the stock per contract at the strike price. If funds are sufficient, the option will be exercised, and you will own the shares.

NOTICE: Since the shares acquired after exercise will appear in your US stock options account holdings instead of your US stock securities account, you will need to sell the shares through your US stock options account.) If there are insufficient funds, the platform reserves the right to automatically close the option position to prevent a margin deficit. In certain situations, if the option buyer's cash or margin is insufficient to meet the exercise conditions, the platform will close the position at market price before expiration (approximately 2 hours before market close) or allow it to expire worthless. A closing fee will also be incurred in this case.

Exercising In-the-Money Long Put Options: If your long put option is in-the-money at maturity, the system will check if you hold 100 shares of the underlying stock per contract. If you hold the shares, the option will be exercised and the shares will be sold.

NOTICE: If you do not hold the shares, the platform may automatically close the option position, which will incur a closing fee. If your US stock options account has sufficient margin and you choose to hold the short position, you will be required to pay the accrued interest. Generally, the margin requirement is twice the market value of the relevant stock, and if the margin is insufficient, you may be subject to forced liquidation without prior notice.

5.3 Options Given up and Early Exercise are not supported: Both given up the rights to exercise and early exercise of US stock options before the expiration date are currently not supported.

[IMPORTANT REMINDER] We will, at various times before the market closes on the option contract's expiration date, calculate the funds required for exercising In-the-Money or Near-the-Money options. If the available USD funds in the Client’s holding account is insufficient for exercising the options, the account may be subject to forced liquidation in the view to avoid a margin deficit after the options being exercised. If you anticipate that your account may have a margin deficit after the option being exercised, please close the position promptly or deposit sufficient funds in advance to meet the relevant margin requirements. Otherwise, we have the right to close the option before expiration, or allow it to lapse and become worthless, or allowing it to be exercised but force liquidating your other positions (including but not limited to the underlying asset of the exercised option).

6. Corporate Actions

6.1. Impact of Corporate Actions: You acknowledge that corporate actions, including but not limited to dividends, stock splits, mergers, and acquisitions, may affect the terms of your options contracts (e.g., strike price, number of underlying shares).

6.2. Adjustments: Any adjustments to options contracts will be made in accordance with the rules of the U.S. Options Clearing Corporation (OCC). The Company is not responsible for any changes to the value or terms of your options resulting from such adjustments. You are responsible for monitoring corporate action announcements and their potential impact on your options positions.

7. Indemnification and Limitation of Liability

7.1. Indemnification: You agree to indemnify and hold harmless the Company, its affiliates, employees, and partners from and against any and all claims, losses, damages, costs, and expenses arising from your use of the Service or your breach of these Terms and Conditions.

7.2. Limitation of Liability: In no event shall the Company be liable for any direct, indirect, incidental, special, consequential, or exemplary damages, including but not limited to loss of profits, goodwill, or data, arising out of your use of or inability to use the Service.

8. Governing Law and Jurisdiction

8.1. Governing Law: These Terms and Conditions shall be governed by and construed in accordance with the laws of Hong Kong.

8.2. Jurisdiction: You agree to submit to the exclusive jurisdiction of the courts of Hong Kong to resolve any disputes arising from these Terms and Conditions.

Disclaimer: Options trading involves significant risk and is not suitable for all investors. The potential for a complete loss of the entire investment is high. Please read this document carefully to understand the risks and our trading policies before you begin. This FAQ is for informational purposes only and does not constitute investment advice.

What are US stock options and what does "long options trading" mean?

A US stock option is a contract that gives the buyer (the "long" position holder) the right, but not the obligation, to buy or sell a specified number of shares of an underlying US stock at a predetermined price (the "strike price") on or before a certain date (the "expiration date").

"Long options trading" means you are only permitted to buy options. You are not allowed to sell or "write" options. This is a key difference that significantly impacts your risk profile. As a buyer, your risk is limited to the premium you pay for the option contract. You are not obligated to buy or sell the underlying stock.

Buying a Call Option (Long Call): This gives you the right to buy the underlying stock at the strike price. You would buy a call option if you are bullish and believe the stock's price will rise significantly. Your potential profit is theoretically unlimited, and your maximum loss is the premium paid.

Buying a Put Option (Long Put): This gives you the right to sell the underlying stock at the strike price. You would buy a put option if you are bearish and believe the stock's price will fall. The maximum profit is limited by the stock's price falling to zero, and your maximum loss is the premium paid.

Why does Well Link Securities only allow "long options trading"?

Our policy is designed to help clients manage risk more effectively. Buying options limits your maximum potential loss to the premium paid, regardless of how much the underlying stock's price moves against you. In contrast, selling or "writing" options can expose you to significant, and in some cases, unlimited losses. By restricting trading to long options, our goal is to provide a more controlled and defined-risk environment for our clients.

What trading platform do I use for US stock options?

You will use Well Link Securities' mobile trading app to trade in the US options market through our designated partner broker. This platform provides the necessary tools and real-time data for you to analyze and trade long options positions.

What are the key terms in options trading?

Underlying Asset: The stock that the option contract is based on (e.g., Apple Inc. (AAPL)).

Strike Price: The price at which you can buy or sell the underlying stock if you choose to exercise the option.

Expiration Date: The last day the option contract is valid. All options are "wasting assets" and will expire worthless if not exercised or sold before this date.

Premium: The price you pay to purchase the option contract. This is your maximum potential loss.

In-the-Money (ITM): A call option is ITM if the stock price is above the strike price. A put option is ITM if the stock price is below the strike price.

Out-of-the-Money (OTM): A call option is OTM if the stock price is below the strike price. A put option is OTM if the stock price is above the strike price. OTM options expire worthless.

Intrinsic Value: The amount by which an option is in-the-money. For a call, it's the stock price minus the strike price. For a put, it's the strike price minus the stock price.

Extrinsic Value (Time Value): The portion of an option's premium that is not intrinsic value. It is the value of the chance that the option will become profitable before it expires. This value decays over time, especially as the expiration date nears.

What are the benefits and risks of "long options trading"?

Benefits:

Limited Risk: Your maximum loss is capped at the premium paid for the option, regardless of the underlying stock's performance.

Leverage: A small investment in an option can control a much larger position in the underlying stock, potentially leading to a higher percentage return on your initial capital.

Flexibility: Long options can be used for speculation (betting on a price move) or for hedging an existing stock portfolio against potential losses.

Risks:

Loss of Entire Investment: If the underlying stock does not move favorably by the expiration date, your option will expire worthless, and you will lose the entire premium you paid.

Time Decay: The value of an option erodes as it approaches its expiration date. This is a significant risk, as the underlying stock may move in your favor but not quickly enough to offset the time decay.

Volatility Risk: The price of an option is highly sensitive to changes in the underlying stock's volatility. A decrease in volatility can cause the option's value to fall.

Liquidity Risk: Some options may not be actively traded, which can make it difficult to sell your position at a fair price before expiration.

Why did my options order not get filled?

Reasons:

Quotes are not synchronized across different exchanges, causing the order to not be filled in a timely manner.

Due to the minimum price increment being different across various exchanges.

As options may involve combination orders, a submitted single-leg buy or sell order may not necessarily be filled. For example, for a certain option contract of BABA, if the bid price is 4.40 while the ask price is 4.50, a single-leg buy order at 4.50 might not be filled because the sell order at 4.50 is part of a combination order.

Due to a lack of market liquidity.

What are the fees and charges for trading US stock options?

Fees and charges for long options trading may include:

Commission: A per-contract fee.

Platform Fee: A fee for using the trading platform.

Regulatory Fees: Fees charged by U.S. regulatory bodies.

Clearing Fee: A fee charged by the U.S. Options Clearing Corporation.

For detailed and up-to-date information on fees, please refer to the relevant fee schedule uploaded on Well Link Securities' official website.

How do I get started with US stock options trading?

To begin, you must first open a securities account with Well Link Securities and apply to open trading services for the US stock and US stock options markets. Once approved, you can access Well Link Securities' mobile trading platform. We strongly recommend that you first familiarize yourself with our company's trading and settlement rules and conditions for related products, and fully understand the risks involved before placing any trades.

Trading and Settlement Policies

Trading Hours: The standard trading hours for US options are 9:30 AM to 4:00 PM Eastern Time (ET) (some ETF options trade until 4:15 PM). Trading hours on the platform will correspond to this.

Trading Unit: The minimum trading unit for US stock options is 1 contract, which typically corresponds to 100 shares. (Example: For an NVDA call option with an expiration date of September 5, 2025 and a strike price of $190. Given the current price is $4.9, the contract value is $4.9 * 100 = $490.)

Margin Requirements: When you buy a long call or long put option, the maximum risk is the premium you paid. Therefore, no margin is required for these positions, but you must be aware of the processing procedures for exercising an option that may be involved when you buy an option and hold it until maturity.

Exercising an Option at Maturity: Options that are in-the-money (ITM) at maturity are typically subject to automatic exercise, which usually occurs after the market closes on the expiration date. If the expiration date falls on a holiday, the timing may vary and the options will be exercised the actual execution time.

Exercising In-the-Money Long Call Options: If your long call option is in-the-money at maturity ([NOTE] it will be automatically exercised if the price is $0.01 or above. If it's below $0.01 and you do not exercise or close the position, it will lapse by default and become worthless), the system will check if you have sufficient cash to purchase 100 shares of the stock per contract at the strike price. If funds are sufficient, the option will be exercised, and you will own the shares.

NOTICE: Since the shares acquired after exercise will appear in your US stock options account holdings instead of your US stock securities account, you will need to sell the shares through your US stock options account.) If there are insufficient funds, the platform reserves the right to automatically close the option position to prevent a margin deficit. In certain situations, if the option buyer's cash or margin is insufficient to meet the exercise conditions, the platform will close the position at market price before expiration (approximately 2 hours before market close) or allow it to expire worthless. A closing fee will also be incurred in this case.

Exercising In-the-Money Long Put Options: If your long put option is in-the-money at maturity, the system will check if you hold 100 shares of the underlying stock per contract. If you hold the shares, the option will be exercised and the shares will be sold.

NOTICE: If you do not hold the shares, the platform may automatically close the option position, which will incur a closing fee. If your US stock options account has sufficient margin and you choose to hold the short position, you will be required to pay the accrued interest. Generally, the margin requirement is twice the market value of the relevant stock, and if the margin is insufficient, you may be subject to forced liquidation without prior notice.

Options Given up and Early Exercise are not supported: Both given up the rights to exercise and early exercise of US stock options before the expiration date are currently not supported.

Settlement: US stock options trades settle on a T+1 basis. The settlement of the underlying stock resulting from an option being exercised also occurs on a T+1 basis, following the relevant notice to exercise.

[IMPORTANT REMINDER] We will, at various times before the market closes on the option contract's expiration date, calculate the funds required for exercising In-the-Money or Near-the-Money options. If the available USD funds in the Client’s holding account is insufficient for exercising the options, the account may be subject to forced liquidation in the view to avoid a margin deficit after the options being exercised. If you anticipate that your account may have a margin deficit after the option being exercised, please close the position promptly or deposit sufficient funds in advance to meet the relevant margin requirements. Otherwise, we have the right to close the option before expiration, or allow it to lapse and become worthless, or allowing it to be exercised but force liquidating your other positions (including but not limited to the underlying asset of the exercised option).

Impact of Corporate Actions on Options

Corporate actions, such as dividends, stock splits, or mergers, can directly affect the terms and value of an options contract. These changes are standardized and adjusted by the U.S. Options Clearing Corporation (OCC).

Cash Dividends: Typically, regular cash dividends do not cause a change in the strike price or number of shares per contract. However, large special cash dividends (usually over 10% of the underlying stock's value) may result in adjustments to the strike price and/or the number of shares per contract.

Stock Splits: A stock split will directly affect the options contract. For example, in a 2-for-1 split, one options contract may be adjusted into two new contracts, with the strike price halved.

Reverse Stock Splits: A reverse stock split is the opposite of a stock split. For example, in a 1-for-2 reverse split, two options contracts may be consolidated into one, with the strike price adjusted to double the original price.

Acquisitions or Mergers: When the underlying stock is acquired, the options contract may be converted to cash settlement or adjusted to be based on the new stock of the acquiring company.

【IMPORTANT REMINDER】 When a corporate action occurs, the value of an options contract can be significantly affected. Please pay close attention to any announcements related to the stock underlying your options. If you have any questions, please contact our customer service team promptly.

Introduction to Mutual Funds

Mutual fund (or “fund”) is a tool that pools the funds of many investors for investment purposes. When you invest in a mutual fund, your mutual funds are combined with those of other investors and diversified across various assets or projects, such as stocks, bonds, money market instruments, and other assets. The fund manager decides which assets or projects the fund will invest in, and investors own a portion of the fund based on their investment amount.

SFC-Recognized Funds

Mutual funds that are recognized by the Securities and Futures Commission (SFC) must have their fund management companies, trustees, and/or custodians accepted by the SFC. Fund management companies registered in Hong Kong, depending on their specific business nature, need to be registered with the SFC as investment advisors and/or securities dealers. Individuals managing fund subscription and redemption activities in Hong Kong must also obtain a license from the SFC. The relevant mutual funds must first be recognized by the SFC before they can be openly sold to the public in Hong Kong. This does not apply to private placements (which require investors with professional investor status).

【Note】 A mutual fund recognized by the SFC does not imply an endorsement of the fund, nor does it guarantee that investing in the fund will yield ideal returns.

Product Key Information Document

To help investors understand important aspects of a product before making an investment decision, the SFC has strengthened disclosure requirements for various publicly sold investment products, including funds, investment-linked life insurance plans (investment-linked insurance plans), and non-listed structured investment products.

The《Product Key Information Document》is one of the main regulations for enhanced product disclosure. It uses simple and easy-to-understand language to provide a concise introduction to the main features and risks of the investment product for potential investors. The《Product Key Information Document》typically includes the following sections:

- The Name and Category of the Product

- The Name of the Product Issuer

- Overview of Information

- What is this product (and how does it work)?

- What are the main risks of the product?

- What are the fees and charges involved in the investment?

- Other Information

Therefore, in addition to the common information mentioned above, the《Product Key Information Document》will also contain information unique to individual investment product categories.

The《Product Key Information Document》does not replace the entire set of sales documents. Hence, do not rely solely on the 《Product Key Information Document》to make investment decisions. Before making an investment decision, you must read the entire set of sales documents.

Fund Sales Documents

The fund's sales documents (commonly referred to as the "prospectus" or the "constitution") generally outline the mutual fund's investment objectives and restrictions, features, risk disclosures, fees, trading procedures, circumstances that trigger fund delays, suspension of trading, or even termination of fund operations, and other ways to obtain information about the fund. Hong Kong-issued documents are published in both Chinese and English. For Hong Kong investors, the Chinese version of the Hong Kong-issued documents is equivalent to the English version (even if the subscription prospectus contains any disclosures). In the event of any ambiguity between the English version of the subscription prospectus and another language version, the English version of the subscription prospectus shall prevail.

Risks Associated with Fund Investment

Before making an investment decision, clients should first refer to the fund sales documents and the Product Key Information Document, and should understand the fund they wish to invest in, including investment objectives, investment strategies, risks, fees, trading procedures, etc. Investors should make informed investment decisions based on the sales documents, rather than advertisements and other promotional materials.

How to Buy and Sell Funds Online through Well Link Securities

Currently, mutual funds are only open to Professional Investors (PI) and clients who are not U.S. citizens or U.S. tax residents (except for SFC-recognized funds). When opening an account through the "Well Link Securities APP" (the “APP”) select both the Securities Account and the corresponding fund trading account to enable mutual fund trading. After activating the service, you can buy and sell funds through the "Trading" interface of the "Well Link Securities APP" by entering the fund page.

Online Fund Trading Operations

Most recognized funds are traded at an "unknown price," which means that the net asset value of the fund units you subscribe to will be calculated after the market closes on the day the instruction is issued. The unit price calculated in this manner is generally considered to more accurately reflect the value of the fund on the trading day.

Subscription Process:

1. After logging into the trading interface of the "Well Link Securities APP" and entering the fund page, select "General Fund Account" (if you have not opened a "Wealth Management Account" at the same time, there is no need to select an account).

2. Search for and select the desired fund to view the fund details.

3. Click on "Buy" to enter the buy interface.

4. Enter the desired fund subscription amount (ensure the required funding has been transferred from your Securities Account to your fund trading account; if buying a fund in another currency, complete the currency exchange online through the "Well Link Securities APP" page under "My" > "Securities Services" > "Currency Exchange").

5. Click on "Buy," and the page shall display the fees and estimated settlement amount once your buy order is successfully placed.

Redemption Process:

1. After logging into the trading interface of the "Well Link Securities APP" and entering the fund page.

2. Select the fund you wish to redeem from your fund holdings and click on "Sell."

3. Enter the desired fund redemption portion.

4. Click on "Sell," and the page shall display the fees and estimated settlement amount once your sell order is successfully placed.

【Note】Fund subscription and redemption restrictions: When subscribing a fund, there is a minimum subscription limit per transaction. For funds with "redemption restrictions," such as funds with pending confirmation of portions, they cannot be redeemed until the fund house confirms the portions. Alternatively, funds with a lock-up period can only be redeemed after the lock-up period expires. Additionally, the maximum redeemable limit varies for different funds. If the redemption order on a given day exceeds the fund house's maximum redeemable limit, the fund house will redeem a portion of the portions based on the situation, and the remaining portions will be processed on the next business day. Therefore, the processing date and settlement time for redemption portion will vary, which may also result in different portions being calculated at different net values for the redemption amount.

Cancellation:

After initiating a fund subscription or redemption process, trade order may be cancelled before it is submitted to the fund house for processing (the cut-off time varies as it depends on the policy of each individual fund house), generally before 14:00 on trade day (“T day”), by searching for the corresponding order in the order details section on the fund trading page of the APP and cancel the trade order.

Fund Holding Net Value and Returns

This refers to the unit net value of the fund over a certain period, and the data is generally updated after the trading day ends. Clients can refer to the account statement or view the holding details under the fund trading page of the "Well Link Securities APP."

Subscription orders unconfirmed by the fund house are considered pending confirmation amounts in the fund holdings, as those have not yet been reflected in the fund holding portions until the fund house confirms the subscription’s completion. Conversely, redemption orders unconfirmed by the fund house are considered pending confirmation portions in the fund holdings, as those have not yet been reflected in the account’s funding until the fund house confirms the completion of the redemption.

The calculation of fund returns is based on the changes in the net value the fund holdings, including all dividend amounts during the holding period, such as cash dividends (if any). The holding returns of the fund refers to the total returns amount of the fund during the holding period. When a fund subscription is made and the amount is not yet confirmed, the absolute value of the holding returns will still decrease accordingly, even if the fund holding portions and its cost price remain unchanged.

Receipt of Fund Return

The fund returns only start to accrue once the subscribed fund portions have been confirmed by the fund house. Fund returns are credited on each trading day, except for weekends, holidays, or special days, where fund returns are accumulated on non-trading days and credited on the next trading day, based on the actual crediting time.

Fund Dividends

Fund dividends refer to the distribution of a portion of the fund's earnings in cash to fund investors, and the frequency of distribution depends on the individual fund itself. If the name of the fund ends with "Dis," it generally indicates that the fund pays dividends, while accumulation funds do not pay dividends. On the dividend record date (usually the day before the ex-dividend date), clients who hold the dividend fund portions are entitled to receive dividends. On the ex-dividend date, the net value of the fund unit may decrease, which may result in a decrease in the net value of the fund holdings. However, when the dividend amount is included, the return may still be positive. After the ex-dividend date, the corresponding estimated dividend amount will be in transit until the dividend is credited to the client’s corresponding account.

Trade Settlement of Fund

Trade Settlement

Funds are processed on T-day (the trading day) specified by the fund house, which refers to the working day when the fund house accepts investors' subscription and redemption transactions within the specified time. Different fund houses may have different cut-off time for the T-day.

(Example)

If a fund house's T-day cut-off time is 11:00, then from 11:00 of the previous trading day to 11:00 of the next trading day is considered within the same T-day, and from 11:00 of the last trading day before weekends and public holidays to 11:00 of the first trading day after the holiday is considered the same T-day. If client buys/sells the fund before 11:00 on the same day, it is considered an order for that day, whereas if the subscription/redemption is made after 11:00, it is considered an order for the next trading day.

【Note】Unsettled trades or pending sell trades are not included in the sellable value of the fund holdings.

Money Settlement

The settlement amount from redemption will be transferred back to the client’s trading account. The required turnaround time for bond funds and equity funds settlement will be relatively longer than that for money market funds. Clients can view the corresponding details in the fund trading page within the "Well Link Securities APP."

Introduction on Bond

A bond is a debt instrument issued for the purpose of raising funds by borrowing from investors over a pre-specified period of time. The bond issuer generally promises to repay the principal and interest on a specified date. The market may refer to bonds as "Notes," which are different names but refer to the same type of debt instrument.

The Characteristics of Bond:

Risk of Investing in Bond

Some investors hold bonds over a long period of time in order to earn a stable interest income, while others buy and sell bonds to capitalize on the price difference. Any investment involves risks, and bonds are no exception. The major important risk is whether the issuer can pay interest and repay the principal at by end of the Term, which is the so-called credit risk. Moreover, the liquidity of bonds will gradually weaken as they approach maturity. Around a week before the expiration date, there may be a situation where trading cannot be carried out due to insufficient liquidity. Before making investment decision, clients should read the sales documents to understand the characteristics of the bonds and the risks involved

How to trade bonds online through Well Link Securities

Currently, bonds are only available to professional investors (PIs) and clients who are not US citizens or US tax residents (except US Treasury bonds). When opening an account via the "Well Link Securities APP", you can open the corresponding account(s) by checking both the securities account and the mutual fund and/or bond account selection boxes. After opening a bond account, you can enter the bond page through the trading interface of the "Well Link Securities APP" to buy and sell bonds.

Online bond trading steps

For BUY trade:

1. After logging onto the trading interface of "Well Link Securities APP" , click to enter the bond page

2. Search and select the desired bond to trade and browse the relevant bond details

3. Click "BUY" to enter the BUY interface

4. Enter the par value and the desired buying price of the bond, or place an order based on the reference selling price (this price is for reference only, the actual execution trade price may be different)

5. Click “BUY”. After the order is successfully submitted, it will be pending for manual trade matching.

For SELL trade:

1. After logging onto trading interface of "Well Link Securities APP", click to enter the bond page of the trading interface

2. Select the bond to sell from portfolio holding(s) and click "Sell"

3. Enter the par value and the desired selling price of the bond, or place an order based on the reference buying price (this price is for reference only, the actual execution trade price may be different)

4. Click "SELL". After the order is successfully submitted, it will be pending for manual trade matching.

【NOTICE】After submitting an order, it may not be executed immediately given bonds are over-the-counter transactions which relies on traders to match transactions. Therefore, the transaction time and price are affected by various factors such as market liquidity and counterparty conditions on the transaction day. Client may wait in patience for the right counterparty and the market price to surface before matching the trade, or try to facilitate the transaction by raising the buy price or lowering the sell price.

The minimum subscription amount and market value of bonds

Bond transactions are usually placed in integer multiples of the minimum subscription amount of bonds (known as the "minimum subscription amount"), that way increases the likelihood of trade matching. For the minimum subscription amount, please log in to the trading interface of "Well Link Securities APP" to browse the details of each individual bond. Although order placement and execution of non-integer multiples may be supported, but the minimum subscription amount and incremental amount various from bond to bond.

The market value of bond holdings

The market value of bond held is the Market Value of the bond on hand x the Reference Middle Price ÷ Bond Face Value + Accrued Interest on bond holdings. Among them, the reference middle price is taken as the sum of the Bid reference price and the Ask reference price. The par value of a bond is usually 100.

Calculation of bond order amount

For BUY:

Total amount of Buy Order = Buying Price × (Face Value ÷ Face Value of a single bond) + Accrued Interest + Total Fees

(Example) Assume that the buy order price is 100, the face value is USD200,000, and it is finally executed at a price of 99.1, the accrued interest is USD500, and the transaction fee totals USD170. The amount payable is 99.1 × (200,000÷100) + 500 + 170 = USD198,870

[Note] Bond buyer must pay bond seller the accrued interest for the period the seller holds the bond. Although bonds generally pay dividends every six months, accrued interest will be calculated every day after bought and hold. Accrued interest will start to recalculate after the dividend is paid.

For SELL:

Total amount of Selling Orders = Selling Price × (Face Value ÷ Face Value of a single bond) + Accrued Interest - Total Fees

(Example) Assume that the selling order price is 100, the face value is USD200,000, and it is finally executed at 100.1. The accrued interest is USD500, and the transaction fee totals USD170. Then the amount receivable is 100.1 × (200,000÷100) + 500 – 170 = USD199,530

[Note] Bond seller receives the accrued interest from the bond buyer.

【Notice】The estimated order amount shown on the bond trading interface does not necessarily equal to the actual transaction amount. The reason for that is the estimated amount only refers to the estimated (BUY) payable and the estimated (SELL) payable based on the order price and face value, where transaction fees are not included in the calculation. The specific formula is:

Order Price x Face Value ÷ 100 + Accrued Interest per unit# + Accrued Interest Buffer^

#Accrued Interest per unit: the Par value of a single bond order on that day x Coupon Rate x Interest Calculation Factor*

*Interest Calculation Factor: depends on the interest calculation basis. Different bonds have different interest calculation basis. The general interest calculation basis is 30/360. Therefore, the interest rate coefficient here is calculated as 30/360, which is equal to [360 x (Y2-Y1) + 30 x (M2-M1)+(D2-D1)] ÷ 360, where

- (Y1/M1/D1) refers to the year/month/day of the last interest payment of the bond (if it is the first interest payment, it is the issue date)

- (Y2/M2/D2) refers to the year/month/day to which the interest of the bond is accumulated or the settlement date of the transaction

(EXAMPLE)

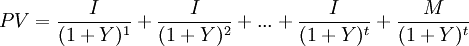

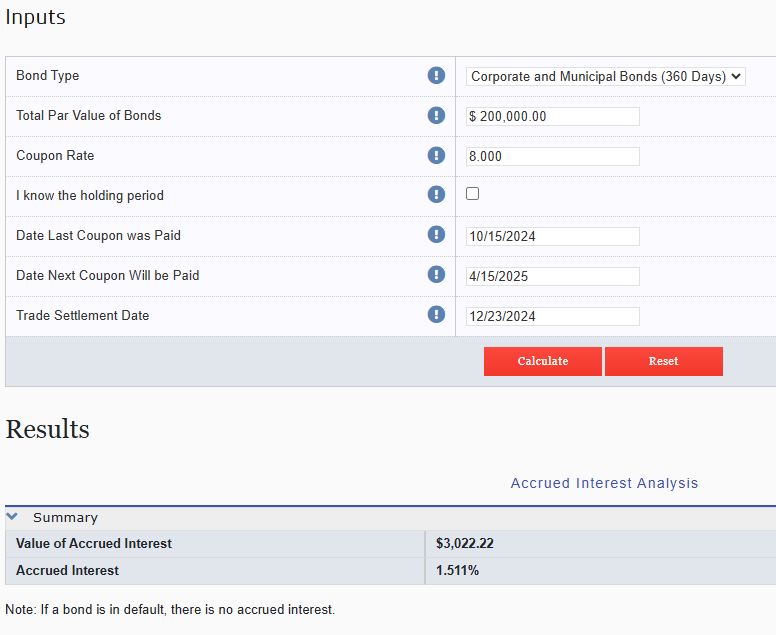

Assume that the coupon rate of a bond is 8.0%, with interest paid semi-annually. The last interest payment date and the next interest payment date are 2024/10/15 and 2025/04/15 respectively. The Accrued Interest per unit accumulated to 2024/12/23 is 100 x 8.0% x [360 x (2024-2024) + 30 x (12-10)+(23-15)] ÷ 360 = USD1.51

For a bond transaction, the accrued interest calculation formula is: Accrued Interest per unit x Face Value ÷ Face Value, that is, USD1.51 x 200,000 ÷ 100 = USD3,022

[Note] Bonds traded on T day will be settled on T+2 day, and the accrued interest will be accumulated to T+2 day. If the bond defaults, no interest will accrue.

Reference source: https://accruedinterest.nga.finra.org/calculator/

^Accumulated Interest Buffer: When the order validity period is "valid for the same day", the value of the accrued interest buffer is 0; when the order validity period is "valid within one week", the value of the accrued interest buffer is the coupon interest of the corresponding 9 days of the order

Settlement of bond trading

Bond Settlement

Bonds are generally settled after 2 Trading days (“T” refers to the trade day), which means that after bonds are bought on T day, they can be sold as early as T+3. Of course, you can also hold it until maturity, or sell it before maturity during trading hours.

[Note] Bonds that have not been settled or delivered or pending for sell on the market are not included in the sellable face value of bond holdings.

Funds Settlement

The funds for buying bonds are settled on T+1, and the funds for selling bonds are settled on T+2 (T refers to the corresponding securities trading day). Non-trading days for bonds or securities, such as weekend or holiday, its relevant settlement will be postponed.

Bond dividends and payments at maturity

The amount of bond dividends is determined by the coupon rate, and bond dividends are generally paid once a year or twice a year. For example, if you hold a bond with a face value of 100,000 dollars and a coupon rate of 8%, the annual interest will be 8,000 dollars. If the annual interest is distributed in two installments, 4,000 dollars will be distributed each time in that case. It usually takes about a week for our company to obtain the funds from our upstream broker before arranging for distribution into our client’s trading account. However, no interest will accrue If the bond defaults.

The amount receivable from the bond redemption shall be equal to the face value of the position on the maturity date. Generally, the maturity amount shall be paid automatically into the client's trading account within 1 week after the maturity date. Please refer to the actual arrival time for specific details.

By “Well Link Bank(Macau)”

Customers who have opened a Well Link Bank account can deposit funds into their Well Link Securities account through the "WLS" fund deposit function in the Well Link Bank mobile APP. Under normal circumstances, the whole deposit process should take around five minutes.

By other banks transfer

Deposit can be made to the below bank accounts of Well Link Securities Limited (the “Company”) via bank counters, automated teller machine or online banking by bank transfer or telegraphic transfer. Cheques deposited must be crossed and payable to: “Well Link Securities Limited”.

After client made deposit, please return to Well Link Securities mobile APP and initiate a remittance notification in "Deposit Funds" module to notify Well Link Securities to check the payment or via email to cs@wlsec.com or via WHATSAPP to (852) 97991894 or scan the QR code at the bottom of Well Link Securities official website and send it to the corporate WeChat. and call the Customer Service Hotline at +852 3150 7728 (Hong Kong) ; +86 755 8206 0899 (Mainland China) ; +853 8796 5888 (Macau) or your A.E. to notify the Company to register for account entry.

Our company only accept clients depositing funds in their own name and will not accept unidentified cash deposit or any third-party deposits. Please indicate the client’s full name and the relevant Well Link securities trading account number.

Bank Information:

Deposit to Well Link Bank(Macau)

(Macau)Well Link Bank(HKD):

800003790102

(RMB):

800003821113

(USD):

800003818114

SWIFT: BESCMOMX

Bank Name: Banco Well Link S.A.

Bank Address: Finance and IT Center Of Macao, Floor 1C, Avenida Doutor Mario Soares NO. 320, Macau

Deposit to Hong Kong Banks

The Faster Payment System (FPS):HKD

FPS identification code: 106229693

Receiving bank: DBS BANK (HONK KONG) LIMITED

Account name: WELL LINK SECURITIES LIMITED - CLIENT ACCOUNT

The Faster Payment System (FPS):CNY

FPS identification code: 105903041

Receiving bank: DBS BANK (HONK KONG) LIMITED

Account name: WELL LINK SECURITIES LIMITED - CLIENT ACCOUNT

DBS Bank (HKD) :

016-478-788662599

DBS Bank (RMB) :

016-478-788662599

DBS Bank (USD) :

016-478-788662599

For fund withdrawal, clients can issue withdrawal instructions through Well Link Securities’ mobile APP or call the Customer Service Department +852 3150 7728 (Hong Kong) ; +86 755 8206 0899 (Mainland China) ; +853 8796 5888 (Macau) during office hours, or submit the "Withdrawal Instruction Form" ((Subject to client account signature verification) email to cs@wlsec.com. The Company will by settlement rules execute client’s withdrawal instruction upon verification and carry out the fund transfer to client’s designated bank account. NOTE: No Third-party payee’s bank account will be accepted for fund transfer.

NOTE: From Monday to Friday, all instruction received after 2 pm will be processed on the next business day.

For telegraphic transfer to banks in mainland, a telegraphic transfer fee will be charged by the Company, in conjunction with bank’s handling fee and the risk of delay that maybe caused by telegraphic transfer, which of all are borne by the client.

Please note that the settlement date may vary from different trading markets. If in doubt, please contact the Customer Service Department.

How to open an account with Well Link Securities?

Clients may open an account with us through the following channels:

Arrange for witnessing of signature and certification of documentation OR

Transfer an initial deposit of not less than HK$10,000 from a bank account in the client's name via a licensed bank in Hong Kong (Designated Bank Account) to Well Link Securities' designated bank account.

Arrange for witnessing of signature and certification of documentation OR

Transfer an initial deposit of not less than HK$10,000 from a bank account in the client's name via a licensed bank in Hong Kong (Designated Bank Account) to Well Link Securities' designated bank account.

Unit 13-15, 11/F., China Merchants Tower, Shun Tak Centre, 168-200 Connaught Road Central, Hong Kong

For further assistance on account opening, please contact +852 3150 7728 (Hong Kong) ; +86 755 8206

0899 (Mainland China) ; +853 8796 5888 (Macau).

What documents do I need to provide for Account Opening?

Hong Kong Identity Card,

A valid address proof issued not less than three months prior to the account opening date (e.g. Utility bills, Phone bills or bank loan/credit card statements),

Bank account statement

e.g. bank statement, ATM Card with the client’s name and account number

Identity card;

Hong Kong and Macau Entry Permit or PRC Passport,

A stay permit known as “arrival slip” issued by the Hong Kong Immigration Department on entry (not required if not immigrated to Hong Kong),

A valid address proof issued not less than three months prior to the account opening date, including the applicant’s name, address, date and company letterhead (not required if the client’s actual address is the same address shown on ID),

Bank account statement

e.g. bank statements, ATM Card with the client’s name and account number

Identity Card and relevant proof of identity,

A valid address proof issued not less than three months prior to the account opening date (e.g. Utility bills, Phone bills or bank loan/credit card statements),

A stay permit known as “arrival slip” issued by the Hong Kong Immigration Department on entry (not required if not immigrated to Hong Kong),

Bank account statement

e.g. bank statements, ATM Card with the client’s name and account number

How long does it take to complete the Account Opening?

When all required documents are received, we can complete the account opening very quickly, approximately three business days. Customers can trade by logging in our mobile application or by contacting our customer services staff(Log in details for mobile trading will be sent to you through email if it opened by offline witness).

How can I deposit my shares to Well Link Securities?

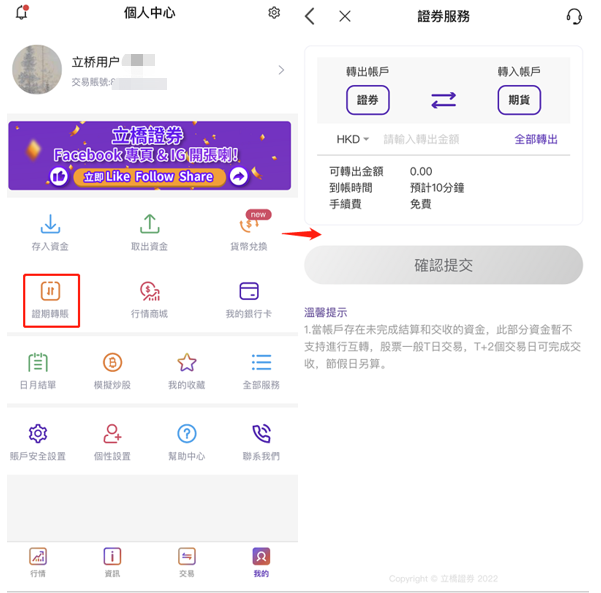

You may submit the "Stock Transfer Notification" via the Well Link Securities mobile APP, by clicking on the homepage [My] > [Securities Services] > [Stock Transfer]. For illustration < Click here >

Alternatively, you may download the Securities Settlement Instruction form here. Then return the completed and signed form to us through:

Customer Service E-mail:cs@wlsec.com or

WhatsApp:+852 9799 1894

Our specialists will contact you to facilitate the process.

(Note: if the transferee is not identical to the transferor, a duly stamped instrument of transfer with a bought and sold notes must be provided.)

For HK Stock - our Settlement Information:

Well Link Securities Participant Code:B01814

Contact Person: Settlement Department

Phone Number:+852 3150 7808 / 3150 7622

E-mail:settlement@wlsec.com

For US Stock - our Settlement Information:

Receiving DTC Participant/Clearing Broke:Velox Clearing LLC

DTC No.:3856

Receiver Account Name/Number:Zinvest Global Limited – Other Client / 88ZG0130

Contact Person: Settlement Department

Phone Number:+852 3852 2183

E-mail:settlement@zvsthk.com

(NOTE: Clients who transfer U.S. Stock positions should provide the latest client account statement issued by the counterparty broker for proof of ultimate beneficiary ownership of their shares position.)

You may download the Securities Investor Settlement Instruction form here. Then return the completed and signed form to us through:

Customer Service E-mail:cs@wlsec.com or

WhatsApp:+852 9799 1894

Our specialists will contact you to facilitate the process.

How do I subscribe in an IPO?

Clients may subscribe an IPO through our online platform or call our customer service hotline +852 3150 7728 (Hong Kong) ; +86 755 8206 0899 (Mainland China) ; +853 8796 5888 (Macau) to place a subscription instruction.

How does Well Link Securities handle Client Deposits?

In accordance to the Securities and Futures (Client Money) Rules established under Section 148 and Section 149 of the Securities and Futures Ordinance, Licensed Corporations must place client deposits and securities in a designated trust account. Well Link Securities strictly oblige to the relevant rules and all client deposits and securities are placed with a trust account in a licensed bank.

Is Well Link Securities free to use Client Assets?

Well Link Securities, as an Exchange Participant of The Stock Exchange of Hong Kong Ltd, since 2005 and 2009 respectively, has been licensed under the Securities and Futures Commission to carry on Type 1 and 2 (Dealing in Securities and Futures) regulated activities. Under strict regulations from the Hong Kong Securities and Futures Commission, it is an offence for Well Link Securities to misappropriate client assets under clear authorized is provided by the client.

What is Investor Compensation Fund?

As an international finance center, the Hong Kong government has always strengthen investor protection

measures. Targeting potential losses faced by investors as a result of offenses committed by the financial

institutions, the Securities and Futures Ordinance has established an Investor Compensation Fund since 1st

April 2003, an independent company responsible for receiving, assessing and determining claims against the

Investor Compensation Fund, making payments to claimants and pursuing recoveries against defaulting licensed

intermediaries or authorized financial institutions. The compensation limit is $500,000 per investor for

trading in securities and futures contracts, respectively.

(For more information on the

Investor Compensation Fund, you may visit www.hkicc.org.hk)

For announcements of the Hong Kong Futures Exchange, please refer to the website of the exchange:

For the Last trading day/expiration date and Settlement date and holiday schedule of Hong Kong futures, please refer to the website of the Hong Kong Exchange:

Given the spot month Hang Seng Index Futures contracts stop trading at 4:00 p.m. on the settlement day, when would the system's Hang Seng Index Futures "Main Link" be switched to the next contract month?

The contract month for the Hang Seng Index Futures "Main Link" takes into account of the market data received from the Exchange, by evaluating the number of open contracts and the trading volume of the relevant futures market before determining which contract month would be linked for the next trading session. The calculation (Open Interest Quantity x 0.9 + Market Volume x 0.1) takes place after the market closes and customers only need to reconnect to the APP’s market date to reflect the update.

For Terms of Service on Futures Trading, click here 《Client Securities Account Agreement SCHEDULE VII: Additional Provisions for Futures Contracts and Options Contracts》

Futures is a financial contract in which buyers and sellers promise to buy or sell a certain related asset, such as stocks, market indices, currencies or commodities, at a predetermined price on a specified date in the future. Investors can buy and sell various futures contracts of relevant assets on the Hong Kong Stock Exchange. They only need to pay a part of the total contract value as a deposit to buy or sell futures contracts. This leverage feature can magnify investors' returns and losses. When the trend of the price of the relevant asset is contrary to the investor's opinion, the risk of being called for margin (“margin call”) may be faced due to a drop in the margin level, and the loss may exceed the margin deposited. Futures contracts are generally settled in cash, and our company does not provide physical delivery of relevant assets.

The risk of loss in trading futures contracts or options can be substantial. In some cases, your losses may exceed the initial margin deposit amount. Even if you may have set contingent instructions, such as "stop loss" or "limit price" instructions, it still may not be able to avoid losses. Market conditions may make it impossible to execute such instructions. You may be required to deposit additional margin at short notice. If the required margin amount is not satisfied within the specified time, your open positions may be liquidated. However, you remain responsible for any resulting shortfall in your account. Therefore, you should research and understand futures contracts and options before trading, and carefully consider whether such trading is suitable for you based on your own financial situation and investment goals. If you trade options, you should familiarize yourself with the rules and procedures, as well as your rights and responsibilities in relation to the exercise and expiration of option contracts.

Therefore, before you trade futures contracts or options, you must have a thorough understanding of the contract terms and trading rules of the relevant products, and you should refer to the relevant information published on the website of the Hong Kong Stock Exchange, and/or consult your professional advisors, as well as carefully consider whether this type of transaction is suitable for you according to your own financial situation and investment objectives.

At present, the company provides Hang Seng Index Futures, Hang Seng China Enterprises Index Futures, Mini-Hang Seng Index Futures, Mini-Hang Seng China Enterprises Index Futures and Hang Seng Technology Index Futures for clients to trade.

| Futures Product | Product Symbol | Exchange | Exchange Min. Price Fluctuation | Contract Size |

|---|---|---|---|---|

| Hang Seng Index Futures | HSI | HKEX | 1 tick = HKD50 | HKD 50 x Index |

| H-Shares Index Futures | HHI | HKEX | 1 tick = HKD50 | HKD 50 x Index |

| Mini Hang Seng Index Futures | MHI | HKEX | 1 tick = HKD10 | HKD 10 x Index |

| Mini H-Shares Index Futures | MCH | HKEX | 1 tick = HKD10 | HKD 10 x Index |

| Hang Seng Tech Index Futures | HTI | HKEX | 1 tick = HKD50 | HKD 50 x Index |

| Contract Month | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

| Symbol | F | G | H | J | K | M | N | Q | U | V | X | Z |

I.The contract symbol of the November 2022 Mini-Hang Seng Index futures contract is MHIX2.

II.The contract symbol of the December 2022 Mini H-Shares Index futures contract is MCHZ2.

III.The contract symbol of the January 2023 the Hang Seng Tech Index Futures contract is HTIF3.

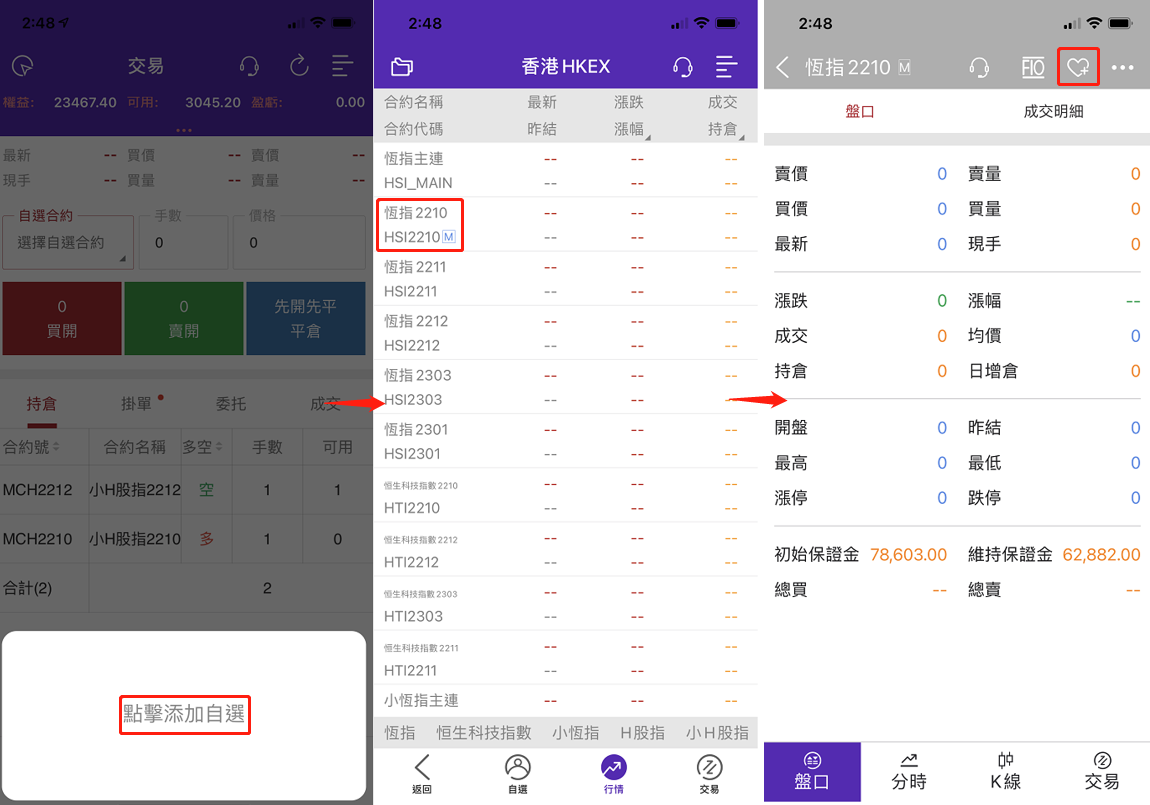

This can be done via the trading APP by clicking the upper sub menu【Futures】under the main bottom menu【Trade】.

In general, 2-3 working days upon application received.

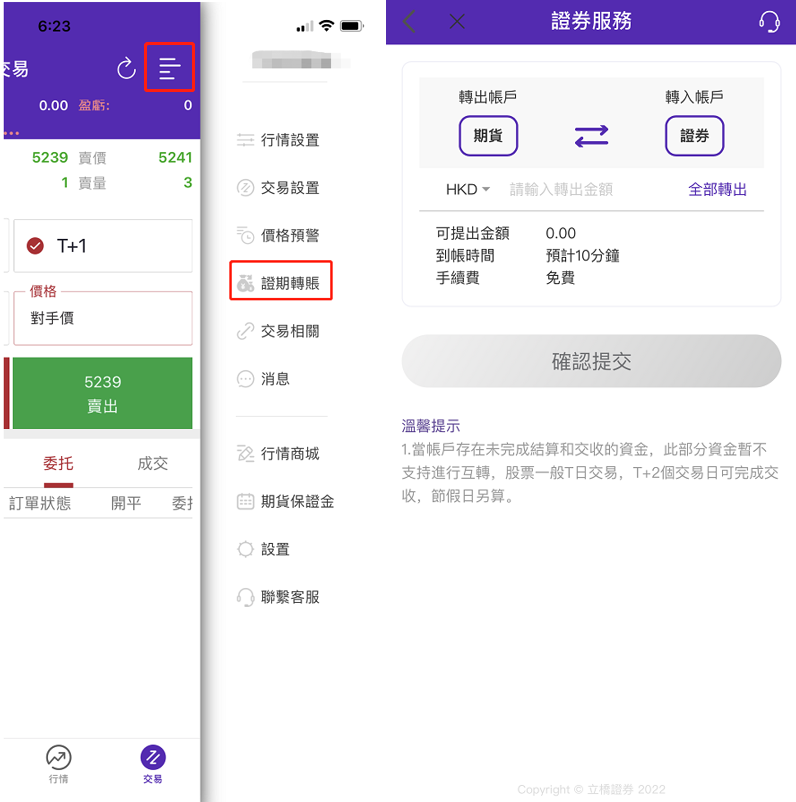

This can be done via the Trading APP by clicking 【My】>【SEC-FUT TFR】, for fund transfer between Securities Trading Account and Futures Trading Account. There is no limit on the transferal amount and it general takes 30 minutes to complete.

If there is any outstanding balance in the receiving account, the system will automatically offset any outstanding amount with any funds transferred into the receiving account first, meaning any fund deposited will go towards the settlement of any existing debt accumulated in the receiving account with upmost priority. Clients should pay attention to this account offset arrangement before transferring funds between their securities and futures trading accounts so as not to affect their funding and trading management.

This can be done via the Trading APP by clicking 【My】>【SEC-FUT TFR】, for fund transfer between Securities Trading Account and Futures Trading Account. There is no limit on the transferal amount and it general takes 30 minutes to complete.

If there is any outstanding balance in the receiving account, the system will automatically offset any outstanding amount with any funds transferred into the receiving account first, meaning any fund deposited will go towards the settlement of any existing debt accumulated in the receiving account with upmost priority. Clients should pay attention to this account offset arrangement before transferring funds between their securities and futures trading accounts so as not to affect their funding and trading management.

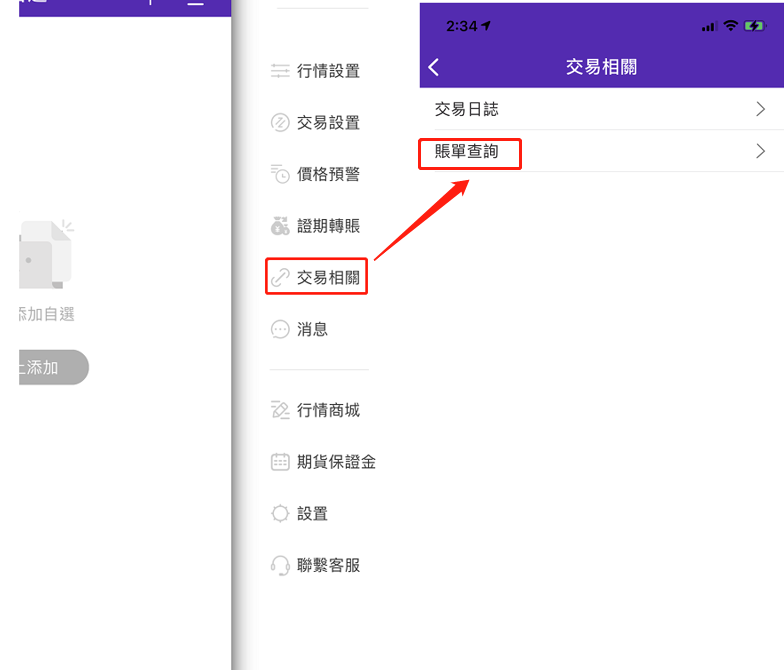

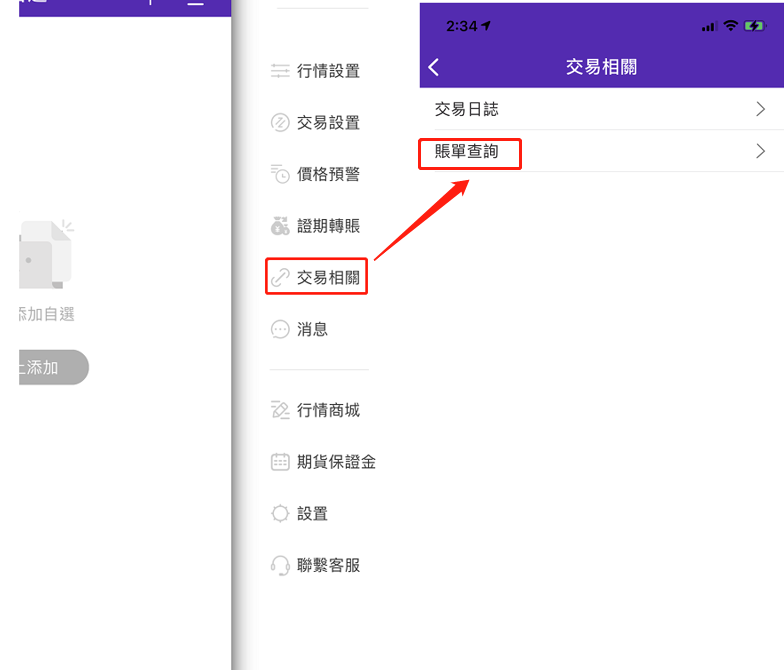

Client can use the【Trade Related】function under the【Main Menu】to review their Futures Trading Account Statement online.

Futures Trading Account Statement can be viewed online and sent via email. Accounts Statements are encrypted and protected by a password. Client will need to enter the last 6 digits of their Identification document registered during their account opening (ID card/passport for individual clients, business registration/company registration certificate for corporate clients). Enter directly if less than 6 digits, parentheses should be left out. As follow:

Trade transactions executed during the Day Session (T) will be reflected on the daily account statement for that trade day, whereas trade executed during the After-Hours Trading (AHT) Session (T+1) will reflect on the daily account statement for the next trade day.

Before subscribing Market Data for Futures Trading, client shall be aware their subscribed market data will become effective on the next business day. Please “Logout” of the APP and re-login to effect the subscribed market data. Once the subscription order had been accepted with subscription fee deducted from the account, no refund, change or cancelling. Please operate with caution.

The trading APP or trading system does not provide any market data for futures trading if clients do not subscribe for futures market data, as such any futures account information that may rely on futures market data to display correctly will not be accurately reflected, which may even effect the normal course of futures trading. Client must acknowledge the relevant risks and take full responsibility for any losses that may be caused by the lack of futures market data before engaging in any futures dealing. If clients decide to conduct futures trading before having successfully subscribed to futures market data, please be fully aware of the associated risks.

The market closing time for trading expiring contract month futures on the last trade day is 4:00 p.m.

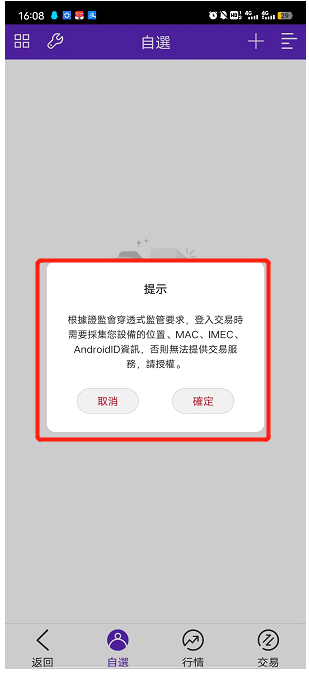

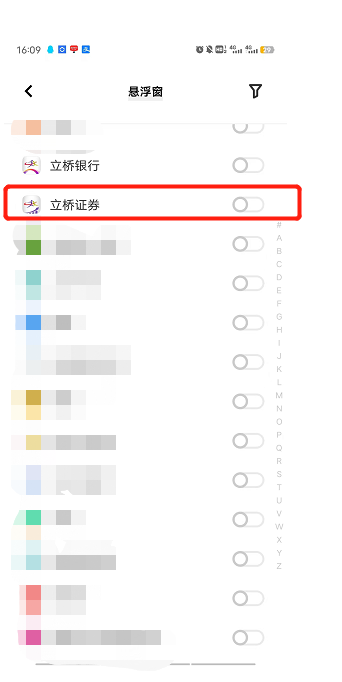

Client will not be able to login their Futures trading account if they do not authorize the APP to collect their device information by selecting【Cancel】and re-selecting manually is mandatory if they wish to re-login their Futures trading account.

Upon logging in the first time, the client is required to configure the authorization settings for Push Notification in order to receive system messages, including but not limited to trade order status notifications, such as the success or fail of order placement and order cancellation.

Client not receiving system messages in time due to them not authorizing the APP for collecting information from their device by selecting 【Cancel】shall be fully responsible for any loss that may cause as a result. After selecting 【Cancel】, client may still be able to configure the permission settings for APP push notifications via the setting menu on their mobile device.

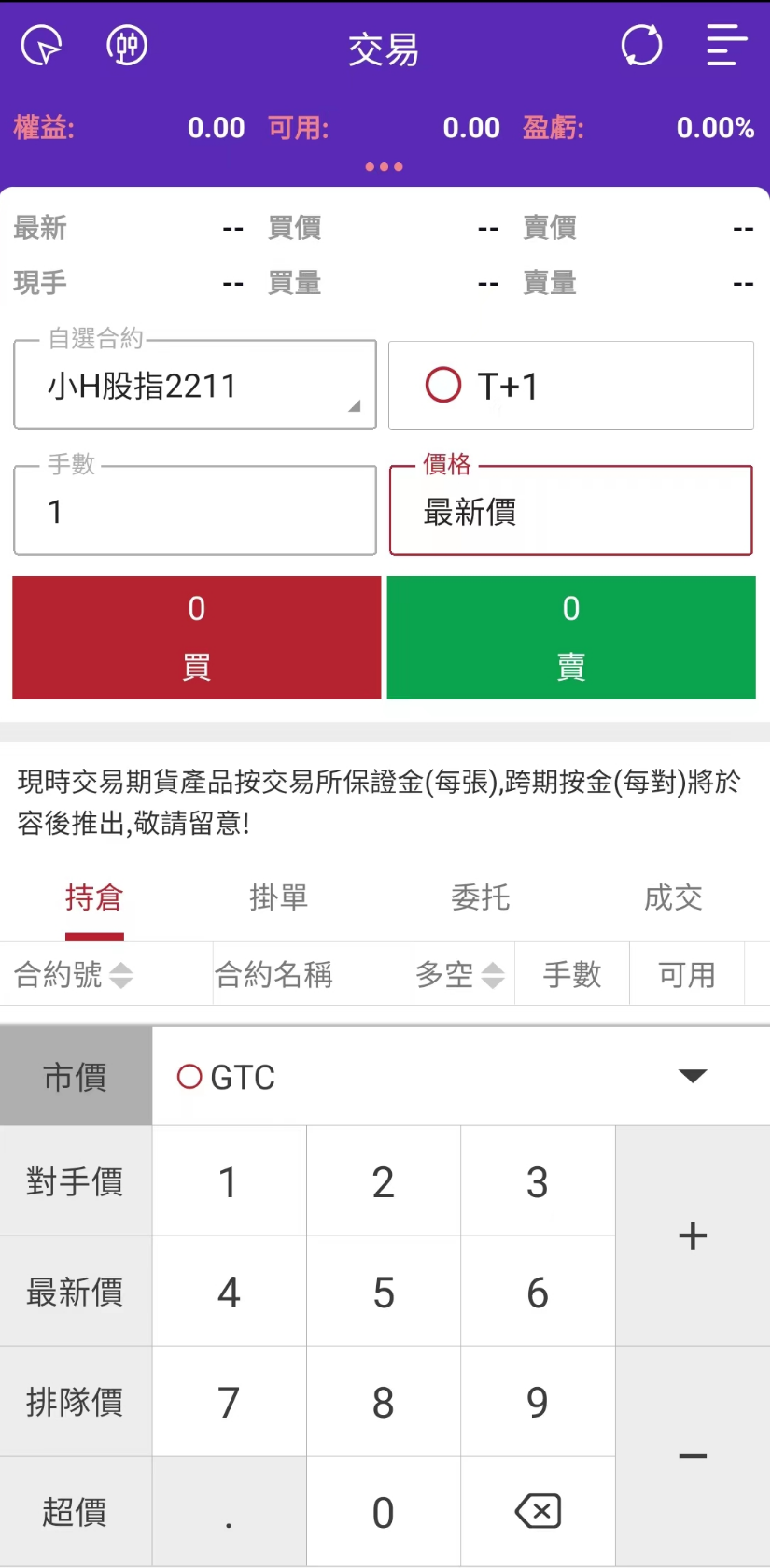

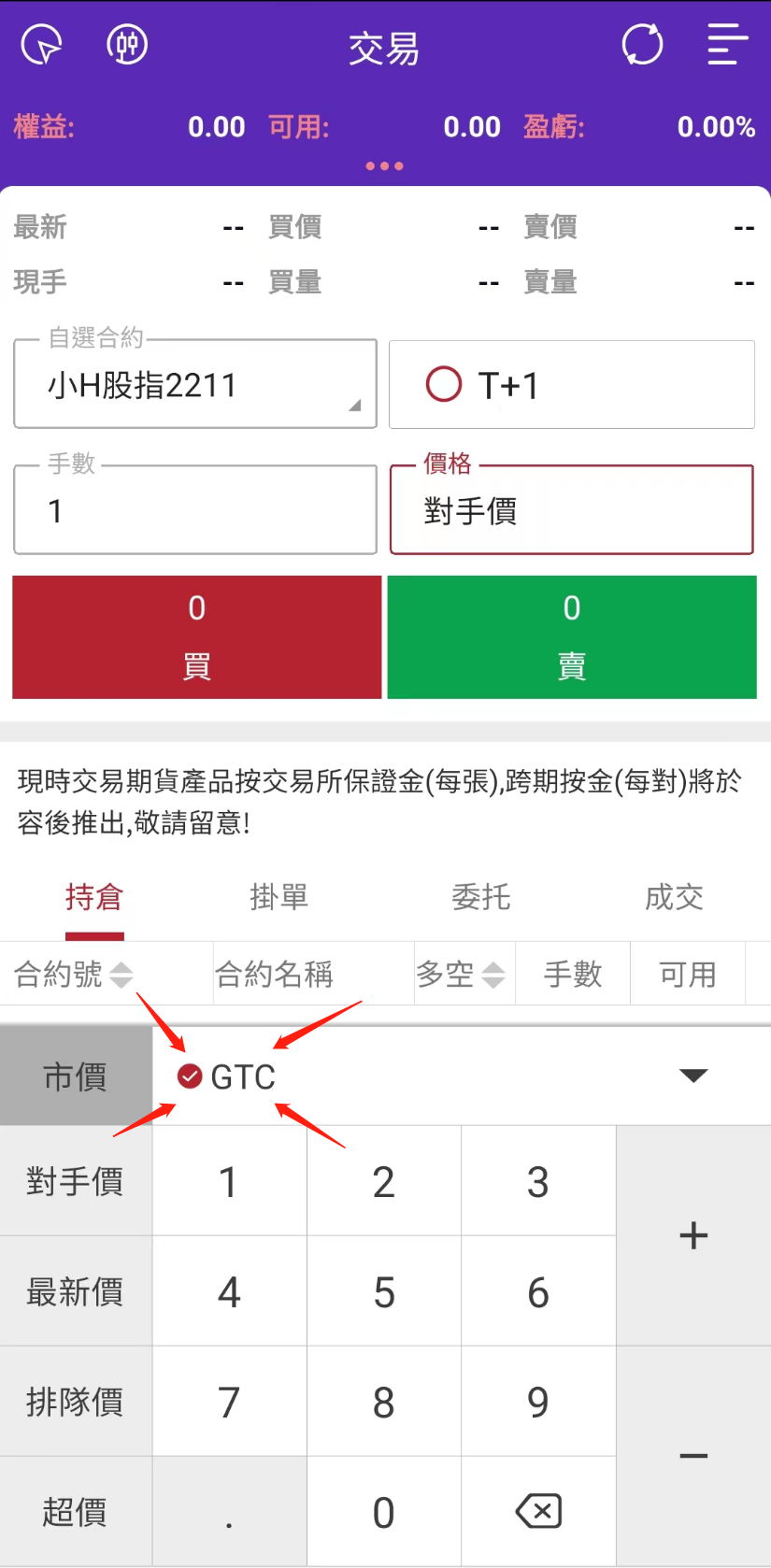

Click the “T+1” tick box when placing order will extend the validity of the trade order onto the After-Hour Trading (AHT) Session.

I. Limit Order

>> Limit Order is a trade order with a price limit. Clients can enter a BUY order or a SELL order with a price according to the specifications and rules of trading that particular futures contract.

>> If a client places a Limit Order in the Pre-Opening Allocation Period during the Morning Session or the Afternoon Session, the system will default the order as an Auction Limit Order and engage in Order Matching during the Open Allocation Session, any unmatched Auction Limit

Order(s) will be automatically converted back to a Limit Order when the Continuous Trading Session begins.

>> Futures Products available for trading: Hang Seng Index Futures (HSI), Hang Seng China Enterprises Index Futures (HHI), Mini-Hang Seng Index Futures (MHI), Mini-Hang Seng China Enterprises Index Futures (MCH) and Hang Seng Technology Index Futures (HTI)

II Bid/Ask Price

Set the order price at the level one Bid/Ask price for matching, if the order is partially filled, the remaining unfilled order quantity will remain in queue as Limit Order.

III. Nominal Price

Set the order price at the nominal price, if the order is partially filled, the remaining unfilled order quantity will remain in queue as Limit Order.

IV. Queue Price

Set the order price at the best price queue, if the order is partially filled, the remaining unfilled order quantity will remain in queue as Limit Order.

V. Transcend Price

After the trade order price is entered (regardless of which of the above price type have been selected), the Transcend Price feature may be used to add extra tick(s) onto the trade order price to increase the likelihood of order matching especially given volatile market situations. Clients

may pre-set the number of tick(s) under【Main Menu】> 【Trade Settings】> 【Transend Ticks】and the default number of tick is 1.

Unless ”GTC” or “T+1” are selected (Refer to screenshot below)。

Clients who choose to place GTC orders must pay attention to the latest order status of their trade orders from time to time. Well Link Securities Limited will not guarantee the validity period of GTC orders.

I. Unfilled orders placed during the Day Trading session are valid until the current trading session closes by default, and all unfilled orders automatically become invalid after the market closes (16:30).

II. Unfilled order placed during the Day Trading session with [T+1] selected, and the validity period of the order will be extended to the After-Hours Trading session ([T+1]).

III. Orders placed during the After-Hours Trading session【T+1】are defaulted to the current session, and there is no need to select [T+1]. Please be aware.

IV. Regardless of whether [T+1] is selected or not, unfilled orders placed during the After-Hours Trading session will be stay valid until the current trading session closes (03:00 am) by default, and all unfilled orders will automatically become invalid after the market closes.

Before opening a new position, the client must first make the necessary initial deposit as Initial Margin, for which the required amount may be adjusted from time to time according to the Exchange’s requirements, otherwise opening a new position is prohibited (except for clients whom have been approved as “Established Client”). The buying power available within the clients’ futures trading account must meet the above-mentioned requirements when opening a new position, those clients whom are on margin call are not allowed to open new position.

Futures Margin Requirements is divided into "Initial Margin" and "Maintenance Margin", whereas the Maintenance Margin is 80% of the Initial Margin. The amount required for the Initial Margin will be adjusted from time to time according to the requirements of the Exchange, at least adjusting monthly, and it will also be adjusted upward in response to market fluctuations or prior to local long holidays. Before clients open a new position, their futures trading account must have sufficient Initial Margin deposited, while after opening a new position must have sufficient Maintenance Margin in place. All futures margin security deposits must be in cash.

I. Margin for Unilateral Futures Contract

For details, please refer to the Exchange website:

II. Margin for Spread Futures Contracts

Spread Futures Contract trading is a single futures contract of the same category or the same trading product in different contract months, trading in opposite directions simultaneously.

At present, Well Link Securities Limited’s margin policy for each pair of the Spread Futures Contracts traded by any client will be treated as two independent (Unilateral) futures contracts in terms of margin security deposits requirements.

At time of volatile market conditions, the margin security deposits required from the client may be raised to a level higher than the Exchange's Initial Margin requirement, which in turn triggers a margin call. As such, the client may be called for margin and demanded for additional fund deposits in a short period of time, in order to maintain the Initial Margin level of their positions. If the additional margin requirement is not satisfied within the specified time, the client may be forced to close the position at a loss, and all losses arising therefrom, including any amount owed after closing the position, must be borne by the customer.

When the net position value or asset value of the client’s futures account falls below the Maintenance Margin level, the client will be called for margin security deposits, and the request for margin will usually be triggered according to the risk ratio of the client’s position. When the client is being called for margin, the client should quickly replenish their margin level to the Initial Margin level, or implement adequate risk management in a timely manner by closing their open position(s). Unless the margin call requirement is satisfied, the client will not be allowed for fund withdrawal from their account or opening new positions.

I. When the【Maintenance Margin】ratio in the client's futures account falls to 100% or below, a margin call notification will be issued, and the client should make the necessary margin deposit as soon as possible or voluntarily close the position until the net asset value returns to the【Initial Margin】requirement level above.

II. When the【Maintenance Margin】ratio in the client’s futures account falls to 75% or below, further margin call notification will be issued, and the client should immediately make the necessary margin deposit or voluntarily close the position until the net asset value returns to the【Initial Margin】requirement level above.

III. When the【Maintenance Margin】ratio in the client's futures account falls to 63% or below, forced liquidation may be executed at any time without prior notice or warning until the net position value or asset value of the client’s futures account returns to the【Initial Margin】requirement level.

If the client fails to make the margin call amount within the specified time limit, Well Link Securities Limited has the right to exercise risk management protocol by forcefully closing the position for the client (“force liquidation”) after the specified time limit, without further notice.

I. If the client’s futures trading account is called for margin securities deposits during the Day Trading session (T), the client must ensure the latest margin call amount in full is available within their futures trading account by 04:00 p.m. on that day.

II. If the client’s futures trading account is called for margin securities deposits during the After-Hour Trading session (T+1), the client must ensure the latest margin call amount in full is available within their futures trading account by 09:00 a.m. in the morning of the next trading

day.。

By default, futures contract positions will be closed according to the principle of【First Open, First Close】, where the earliest opened futures contract position is closed first, in that order of priority.

I. Clients closed their position during Day Trading session (T) may apply for fund withdrawal of their margin deposit on the same day, whereas the remaining surplus funds (if any) available in their futures trading account may be further withdrawn on the next trading day at the earliest.

II. Clients closed their position during the After-Hour Trading session (T+1) may apply for fund withdrawal on the next trading day at the earliest.

I. If the client holds a cash-settled futures contract and that contract has not been closed at the end of the Last Trading Day, such contract will be settled in cash according to the contract rules of the Exchange.

II. The settlement amount will be deposited into the client's futures trading account before the commencement of the afternoon trading session of the next trading day following the last Settlement day.

I. Simultaneously holding 1 long (short) position in Hang Seng Index futures contract and 5 short (long) positions in Mini Hang Seng Index futures contracts;

II. Simultaneously holding 1 long (short) position in H-Shares Index futures contracts and 5 short (long) positions in Mini H-Shares Index futures contracts.

Well Link Securities Limited (“WLSL”) does NOT provide any services in relation to the【physical delivery】of futures contracts settlement, clients is required to voluntarily close their positions on or before the Last Trading Day. Otherwise, WLSL has the right to forcibly close such position for the client without prior notice, and any resulting losses, including costs, fees and expenses, et cetera will be borne by the client.

Before being treated as an Established Client by Well Link Securities (“WLS”), please read carefully the terms and conditions outlined below.

1. The Established Client shall be an existing client of WLS with overnight trading experiences and able to demonstrate a record of consistently meeting margin obligations and maintaining a sound financial position as defined under the Rule 617(b) of HKFE Rules.